In the fast-paced world of accounting and taxation, time is everything. For professionals, completing tasks on time and managing tax files efficiently are critical to meeting client expectations and staying compliant with regulations. However, the sheer volume of tasks and documents can easily overwhelm even the most organized accountants.

One solution to this challenge lies in something as simple yet powerful as reminders. With an efficient reminder system, you can not only stay on top of your tasks but also ensure that every pending tax file is completed promptly while keeping track of what has already been done. In this blog, we’ll explore the significant impact reminders can have on your workflow and how they can help you manage both pending and completed tax files effectively.

Why Are Reminders Essential for Task Management?

As an accountant or tax consultant, you juggle multiple deadlines—filing taxes for clients, meeting compliance dates, and reviewing financial reports. Without a proper system in place, it’s easy to lose track of what needs to be done. This is where reminders come into play.

1. Meet Deadlines with Ease

The primary benefit of using reminders is that they help you stay ahead of deadlines. Whether it’s a tax return submission date or a client meeting, reminders notify you well in advance, giving you time to prepare. This way, you never have to rush through tasks at the last minute, avoiding stress and reducing the chances of errors.

2. Prioritize Your To-Do List

Reminders allow you to prioritize your daily or weekly tasks. Some tasks might have more urgent deadlines than others, and setting reminders helps you arrange your schedule efficiently. Instead of multitasking and losing focus, you can dedicate time to specific tasks, ensuring better productivity and accuracy.

3. Reduce Task Overload

When managing multiple clients or handling complex tax filings, it’s easy to become overwhelmed by the number of things you need to do. By breaking tasks down and setting reminders for each one, you can tackle them in manageable chunks. This prevents task overload and ensures that you always know what the next step is.

4. Avoid Missed Opportunities

Missed deadlines or incomplete tasks can lead to penalties for clients and lost opportunities for your business. With reminders, you get notified at just the right time to follow up, complete necessary tasks, and ensure that nothing slips through the cracks.

How Reminders Help Keep Track of Pending and Completed Tax Files

Apart from managing your day-to-day tasks, reminders also play a vital role in organizing tax documents. Keeping track of pending tax files and knowing which ones have already been completed is crucial for smooth workflow and client satisfaction. Here’s how reminders can streamline this process:

1. Stay Organized with Pending Files

Pending tax files require special attention, as they represent work that’s yet to be completed. Setting reminders for these pending files ensures that you never forget to follow up on them. Reminders can notify you about the approaching deadlines for filing, final reviews, or any necessary documentation that needs to be submitted by the client.

Having a list of pending files with automatic reminders attached to each file makes it easier to prioritize which documents to address first. You can group them based on deadlines or urgency, ensuring that each file is completed on time.

2. Keep Track of Completed Files

It’s not just the pending files that need attention—keeping track of completed files is equally important. By setting reminders to review completed tax files, you can double-check for accuracy and compliance before final submission. A post-completion review reminder ensures that no mistakes are overlooked, and you can be confident that the file is error-free before you finalize it.

3. Sync Reminders with Your Tax Management System

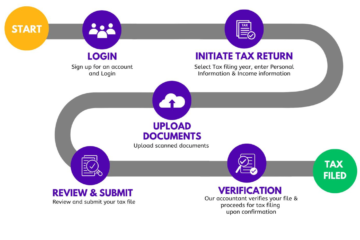

Many tax professionals use software to manage client tax files. By integrating reminders with your CA Office Management Software, you can sync your to-do list with your digital files. This not only makes it easier to keep track of pending and completed tax files but also ensures that you are always on top of deadlines, approvals, and submissions.

Maximizing Efficiency with CA Office Management Software

To take full advantage of the power of reminders, incorporating them into your office management system is key. CA Office Management Software offers integrated reminders that sync with client files, tasks, and deadlines, ensuring seamless task completion and document management. Here’s how using the software can take your workflow to the next level:

- Automatic Reminders for Pending Files: Set up reminders for pending tax files that notify you as the due date approaches. This proactive system ensures that you have ample time to gather information, complete the tax filing, and get final approvals from clients.

- Track Completed Files: Use reminders to follow up on completed files and ensure everything is in order before submission. The software allows you to tag files as “pending” or “completed,” making it easier to track progress.

- Team Collaboration: In a collaborative office, team members can set reminders for each other, ensuring everyone is aligned on deadlines and responsibilities. No more missed tasks, no more confusion—everything is clear and streamlined.

Never Miss a Deadline Again: Empower Your Workflow

Reminders are more than just a helpful tool—they are an essential part of efficient task management. Whether you’re handling multiple clients or managing complex tax files, reminders can ensure that you never miss a deadline, keep track of pending files, and review completed tasks thoroughly.

Adopting a robust system like CA Office Management Software with built-in reminders will empower you to manage your tasks, increase productivity, and deliver better results for your clients. With this technology in place, you can reduce the stress of last-minute deadlines and focus on providing high-quality service to your clients.

Stay on Track with Reminders !

The importance of reminders in the accounting and taxation profession cannot be overstated. Whether you’re managing your to-do list or tracking pending and completed tax files, reminders ensure that you stay organized, meet deadlines, and avoid errors.

By integrating reminders into your workflow, especially through a powerful system like CA Office Management Software, you can automate task tracking, improve efficiency, and enhance your overall performance. Start using reminders today and watch as your productivity soars, deadlines are met, and your tax files are always in order

Are you ready to transform the way you manage your tasks and tax files? Get in touch with us to learn more about how our CA Office Management Software can integrate reminders into your daily workflow and take your office operations to new heights!

GET IN TOUCH